BLDCRX

Build Bond Innovation CIT

CUSIP: 12007F104

Speak with a Build professional to discuss how our retirement solutions may fit into your plan design.

Enter a valid email address.

Overview

Fund Objective

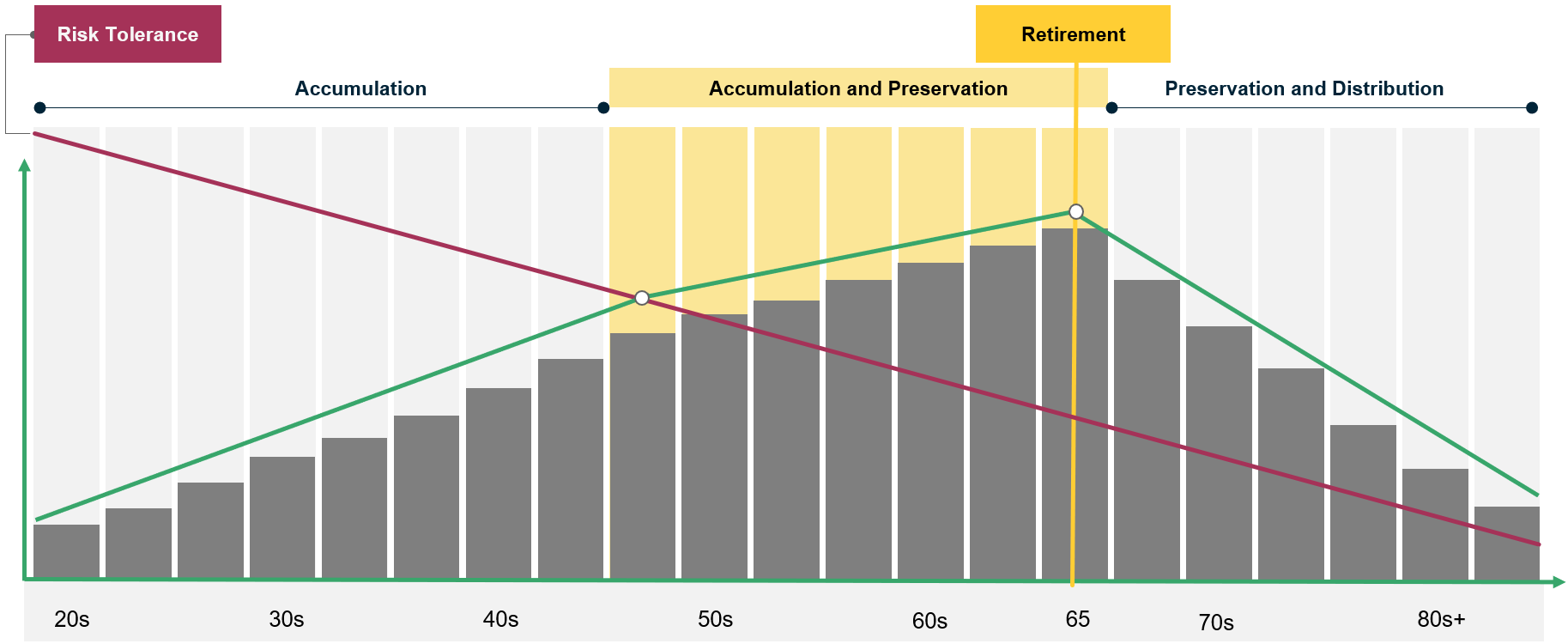

We applied our risk mitigation methodology to retirement-focused funds, seeking to offer investors a spectrum of solutions that match dynamic risk tolerances with their wealth preservation and long-term capital appreciation goals.

- 90% - 100% fixed income and cash

- Investment-grade fixed income

- 6-year max average fixed income duration

- Long-only options to enhance return profile

- Conservative investor objective

Why Invest?

A Methodology Designed for the Modern Era

Many current portfolio construction techniques are outdated, failing the investor because they improperly address risks and do not account for today's market environment. We seek to address these challenges by creating more repeatable outcomes to help investors acheive their financial goals. Build's retirement solutions are built from aspects of structured solutions, passive equity index investing, and active fixed income management, guided by algorithmic rebalancing.

Low Yields

Bond yields have faced over four decades of declines as both equity and bond prices have soared.

Sequence of Return Risk

Withdrawals from an investor's account during bear markets are more costly than during bull markets. They do more damange to the investor's overall return.

Longevity Risk

Life expectancy is increasing and the potential of an investor outliving their retirement savings needs to be accounted for.

Featured Perspectives

Uncertainty Makes Bond Duration Trade a Balancing Act

Some investors may be tempted to “buy the dip” in bonds, but we may not be out of the woods yet.

High Yield Bonds - History Shows that Reaching for Yield Can Lead to Disaster

Reaching for income in high yield bonds is little different than ascending the top step of a ladder to get something just out of reach.

Gaining Perspective Podcast

Can SECURE Act 2.0 get retirement planning back on track? John Ruth talks with Advisor Perspective on the future of retirement planning.

Dot-Com Vs. Covid-19 Markets: Are We In For Another Crash?

We explore reasons why investors could reasonably draw conclusions of future returns from history, but still be caught on the wrong side of the trade.