“With rates at historic lows, signs of inflation beginning to percolate, and an asymmetric risk profile to interest rates, where does one find positive return in a risk-prone fixed income portfolio?”

To answer this question, one needs to understand where “alpha,” or excess return to the benchmark, is derived in fixed income. When you deconstruct fixed income portfolios, whether they are multi or single sector strategies, there are two ways portfolio managers attempt to achieve positive returns. First, fixed income performance can come from sensitivity to interest rates or duration management. Second, the amount of incremental yield investors receives for credit risk, country risk, or other event risks, broadly described as “spread” risk, can be an additional source of return.

Given the current macroeconomic outlook and its potential for low risk-adjusted rates of return (or negative returns like those experienced by fixed income investors in the first quarter of 2021), perhaps a less traditional approach to fixed income portfolio management is required. At Build, we are challenging the conventional wisdom that specific risk buckets in fixed income are appropriate for investors who want a less volatile return path. Build offers an alternative alpha source that provides returns typically associated with fixed income sectors like high yield or emerging markets but with a less volatile return trajectory. And it comes from an unlikely source: long-only call options on large-cap equities. Long equity call options have a unique return profile that have a known, limited downside and provides upside participation in stocks. Given potential growth prospects, options may offer a much better upside return profile.

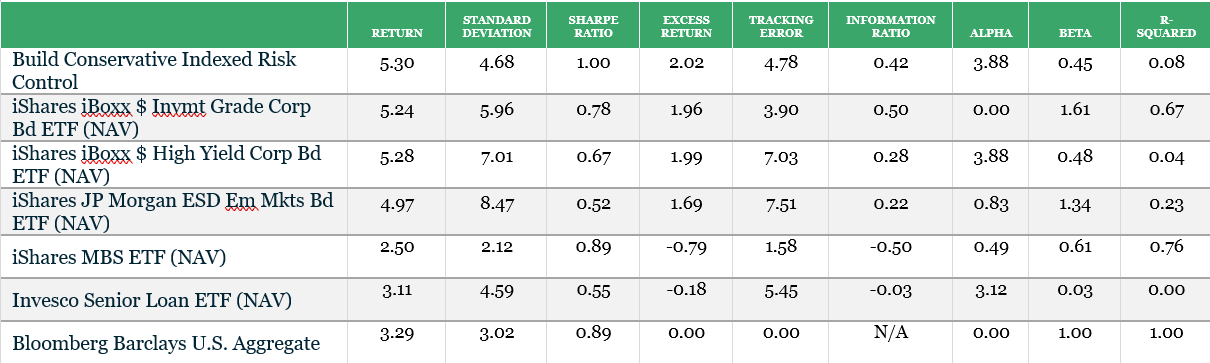

To measure the alpha in fixed income, one can use exchange-traded funds as a proxy for investment-grade credit, high yield, emerging markets (expressed in U.S. dollar terms), mortgage-backed securities, and senior loan strategies. We can then compare the returns of those funds to Build Asset Management’s Conservative Indexed Risk Control™ strategy and the respective sources of alpha. Build’s strategy owns a core group of high-quality (A+), fixed income bonds of U.S. treasuries, investment-grade credit, and asset-backed securities. In addition to the fixed income core, the firm employs the long-call options overlay to supplement returns as equity markets move higher. Build also offers Moderate and Aggressive strategies that provide relatively higher levels of equity exposure, commensurate with an investor’s risk profile. When we compare these fixed income sectors to Build’s Conservative Index Risk Control performance, the results are striking.

Looking back over the last ten years, Build’s Conservative Indexed Risk Control strategy delivers a comparable, or better, annualized return when compared to the various fixed income allocations in our example in the table above. More importantly, it does so with a low Standard Deviation, a higher Sharpe Ratio, high level of Excess Return, Information Ratio, and with a moderate level of Tracking Error. Conservative Indexed Risk Control also delivers excellent Alpha, Beta and R-Squared numbers. What drives this outperformance? It’s Build’s adherence to a truly conservative approach to its fixed income allocation. As mentioned, there are only two levers to pull in fixed income, duration, and spread. And the corollary to that is fixed income outcomes are digital: an investor will either receive its principal in full at maturity (with some income stream in the form of coupons) or get nothing. This 0 or 1 outcome requires a cautious approach to the foundational fixed income portfolio and where alpha comes from. Investment decisions are driven by the desire to protect to the downside and return investment capital. Build’s portfolio philosophy begins and ends with the defense of the portfolio.

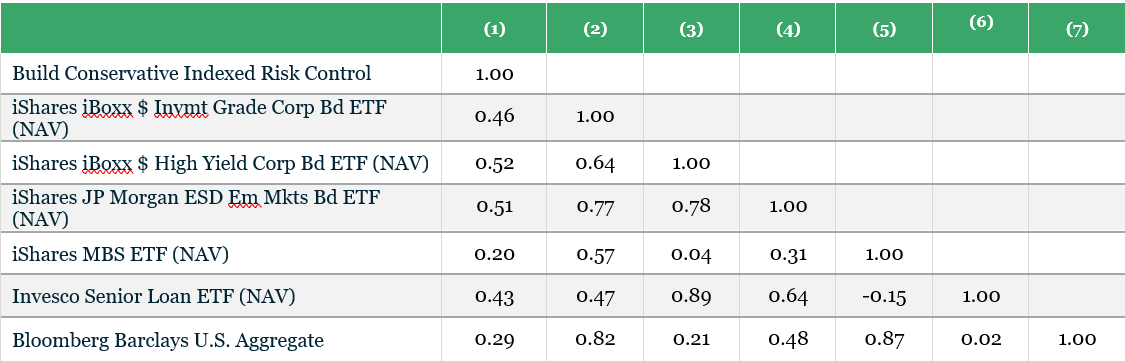

What helps to make Build’s strategy unique is that a significant alpha generator for the Conservative Indexed Risk Control portfolio comes from the long-only, equity call option overlay. While it is not a fixed income asset, this supplement has the added benefit of creating additional portfolio diversification. Looking at the correlation of various fixed income sectors compared to a traditional fixed income benchmark like the Bloomberg Barclays U.S. Aggregate Index (table below), Conservative Indexed Risk Control has a very low (.29) correlation. A review of the strategy’s contribution to return underscores this point. The strategy’s back-tested data shows an average annual return of 6.45%, with fixed income providing 3.61% of that average return and equity options delivering 2.84%, a fairly balanced profile. Last year’s since-inception performance solidified this profile, with a total strategy return of 8.54%, comprised of 6.32% from the options overlay and 2.85% coming from fixed income, and –63 basis points from cash*.

Build believes that this new approach to a fixed-income portfolio construction is designed specifically for our time. Conservative investors are experiencing the punishing consequences of the fiscal and monetary decisions made worldwide after the 2008 financial crisis. In this new regime, investors are forced to seek risk assets for higher returns as interest rates have been intentionally muted by the Fed and easy money policies. Given that the rules have changed, conservative investors must adapt and rethink their approach to conservative investing. Using Build’s approach, investors can be rewarded for equity appreciation without the direct exposure, thereby mitigating sequence of return risk without sacrificing long-term growth.

* The hypothetical back-tested period ranges from December 19, 1991 through January 27th, 2020, and have been independently verified by a third-party auditor. Actual strategy performance begins on January 28th, 2020.