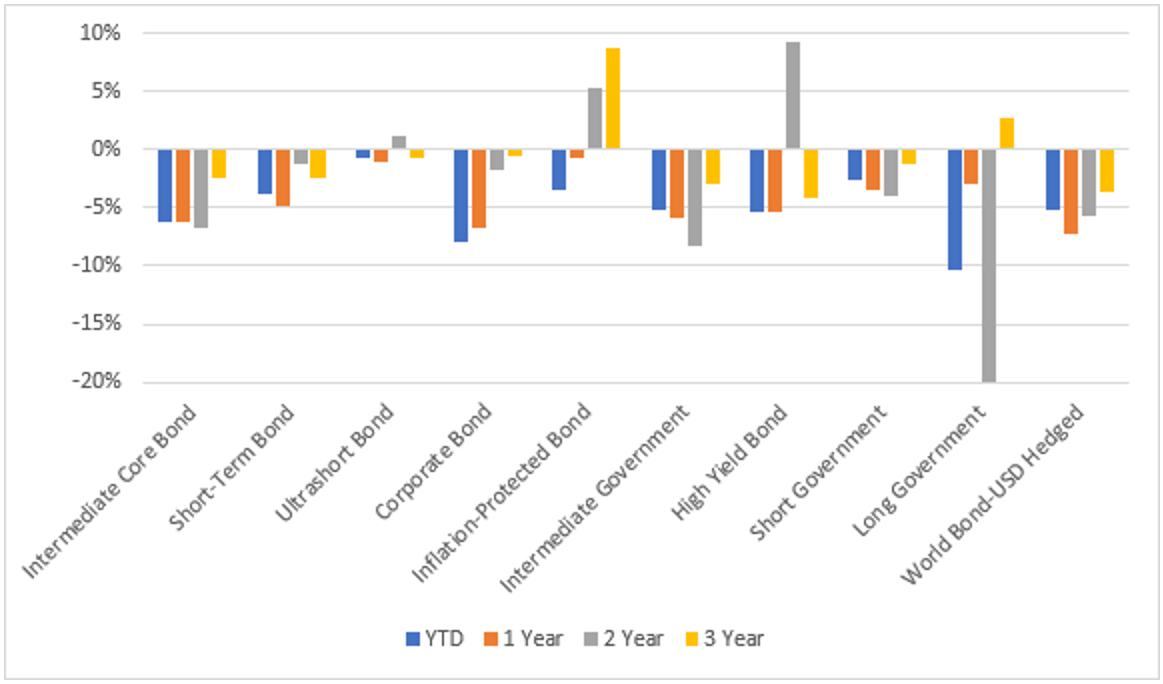

The harsh reality is that if you bought a bond ETF at any point in the last 3 years odds are you may be sitting on a loss right now, at least from a price return perspective. Figure 1 below shows the median fund price return for the 10 largest bond ETF categories by AUM, as defined by Morningstar. In six out of 10 of the selected categories, including the largest—Intermediate Core Bond—the median price return of funds in that category is down on a YTD, 1-Year, 2-Year, and 3-Year basis. There just have been very few safe havens in the bond world of late.

Figure 1: Top 10 Bond ETF Categories: Median Fund Price Return through March 31, 2022

Given the historic pounding bonds have taken recently, does this mean it’s maybe a good time for investors to dive into them? With inflation still raging and more interest rate hikes likely on the horizon, caution is certainly warranted and only time will tell if this is a good entry point. But it is definitely a good time to reassess your current bond exposure.

Taxes are normally on everyone’s mind leading up to the April filing date. However, tax strategies are something that investors can employ year round. After a quarter like we’ve just experienced, tax loss harvesting should be at the top of every investor’s mind. Tax loss harvesting is the act of selling a security at a loss and using that loss to offset taxable gains (realized gains, dividends, capital gains distributions) elsewhere in your portfolio to help reduce taxes. The investor can then reinvest in a different security that may provide a similar risk and return exposure for their portfolio. In this way, the investor can reap benefits of realizing a tax loss while remaining invested for the long run.

With the downward move in bonds this quarter, the price performance of many bond strategies over the last several years, and the performance of most equity asset classes since the trough of the COVID-19 crisis, it’s an opportune time to evaluate and potentially enhance the tax profile of your taxable portfolios. There are likely areas where you can realize gains on the equity side and potentially offset those gains by harvesting losses on the bond side.

The question is now what should you buy to replace the bond strategies you’ve sold? That’s where Build comes in. If you plan to remain in a core bond allocation and want to rotate into a different fund, you should consider The BUILD Bond Innovation ETF (ticker: BFIX, see www.BFIX.fund for more information). BFIX is a bond allocation fund designed for a modern global environment defined by low interest rates and constrained economic growth. Despite the recent surge in inflation and bond yields, Build has conviction that in the long run bond yields will be forced downwards as the global economy continues to rely on debt for growth. The fund seeks to outperform traditional bond strategies under the continuation of low yields and/or rising prices in equity markets. The ETF takes the following approach:

- Defense First. The ETF typically has 90% to 95% of its holdings in investment grade fixed income*, with the intent of providing downside risk management over the long-term. It seeks to maintain a moderate duration profile and requires investment grade credit quality in its bond holdings.

- Upside Exposure Using Options. The ETF invests the remainder of its assets in a rules-based call option overlay tied to the upside performance of the S&P 500 Index.

If you are looking for a high quality, short-to-moderate duration core bond fund and are long term bullish on the US equity markets, this may be the strategy for you. Please visit www.BFIX.fund to learn more.

——————————————————————————————————————–

* Investment Grade Fixed Income – To be considered an investment grade issue, the company must be rated at ‘BBB’ or higher by Standard and Poor’s or Moody’s. Anything below this ‘BBB’ rating is considered non-investment grade.

This article is the opinion of the author and should not be construed as tax advice. Speak to a financial advisor or a tax professional before you consider any tax-related strategy. For more information about the fund, including definitions of terms discussed, please visit: www.BFIX.fund. Alternatively you can call (833) 852-8453 or email info@getbuilding.com to speak with a Build representative.

Investors should carefully consider the investment objectives, risks, charges, and expenses of Exchange Traded Funds (ETFs) before investing. To obtain an ETF’s prospectus containing this and other important information, please call (833) 852-8453, or visit www.BFIX.fund. Please read the prospectus carefully before you invest.

IMPORTANT RISK INFORMATION: An investment in the fund involves risk, including possible loss of principal.

Fixed income investments are subject to interest rate risk; their value will normally decline as interest rates rise. Fixed income investments are also subject to credit risk, the risk that the issuer of a bond will fail to pay interest and principal in a timely manner, or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline. Investing in mortgage- and asset-backed securities involves interest rate, credit, valuation, extension and liquidity risks and the risk that payments on the underlying assets are delayed, prepaid, subordinated or defaulted on.

There is no guarantee that the investment views will produce the desired results or expected returns, which may cause the Fund to fail to meet its investment objective or to underperform its benchmark index or funds with similar investment objectives and strategies.

While the option overlay is intended to improve the Fund’s performance, there is no guarantee that it will do so. Utilizing an option overlay strategy involves the risk that as the buyer of a call option, the Fund risks losing the entire premium invested in the option if the Fund does not exercise the option. Also, securities and options traded in over-the-counter markets may trade less frequently and in limited volumes and thus exhibit more volatility and liquidity risk.

BFIX is distributed by Foreside Fund Services, LLC.